Aetna is pleased to offer Medicare Supplement plans for Pennsylvania Seniors and Medicare Eligible

We can help you choose a Medicare Supplement Plan thats right for you! For assistance call (888) 620-8988

Aetna Medigap Plans offer :

Freedom to use the doctors and hospitals you choose, without needing a referral as long as they

accept Original Medicare

Peace of mind that comes with having coverage while you travel anywhere in the US,

at any doctor or hospital that accepts Original Medicare. World Wide emergency coverage

is also included.

Coverage for some or all of the health care costs that Medicare "doesn't cover," which may include deductibles, copayments, and coinsurance that you are left to pay under Original Medicare

Understanding Medicare

Medicare is health insurance for people 65 and older, under 65 with certain disabilities, and any age with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a kidney transplant). Original Medicare provides medical coverage for doctor and hospital services.

What is Part A?

Medicare Part A is a type of hospital insurance provided by Medicare. The coverage provided by Part A includes inpatient care in hospitals, nursing homes, skilled nursing facilities, and critical access hospitals. Part A does not include long-term or custodial care. If you meet specific requirements, then you may also be eligible for hospice or home health care.

What is Part B?

Medicare Part B is medical insurance; coverage includes (but isn’t limited to) medically necessary doctor services, screenings, outpatient hospital care, and other services that Part A does not cover, such as some physical or occupational therapies and some home health care services. Part B also covers durable medical equipment.

Top 5 Reasons Why You Should Purchase a Medigap Policy

1. Protection against large medical bills

Under Medicare Part B, 80 percent of your total costs may be taken care of, but 20 percent of the bill is still your responsibility

2. Coverage outside of the United States

If you’re on vacation outside the U.S. and an accident or sudden illness happens to you, Medicare Supplement plans will help cover medical expenses outside of the country.

3. Guaranteed acceptance

The best time to buy a Medigap policy is during your Medigap “Open Enrollment Period”. Your Medigap open enrollment period lasts for six months. It starts on the first day of the month in which you are turning 65 or just enrolled in part B of Medicare.

4. Choice of any doctor or hospital

Under most Medigap policies, you’ll be covered if you visit any doctor and hospital that participates in Medicare.

5. Standardized policies

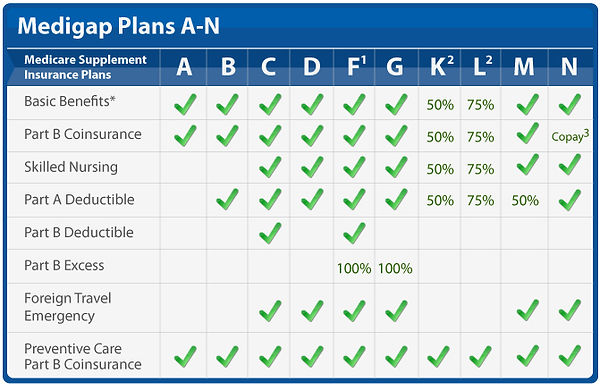

All 10 of the standardized Medigap policies are regulated by law; all the benefits from each separate plan are the same, regardless of who your insurer is or (in most states) where you live. This is important to note when comparing prices with various insurance companies.

Standardized Medigap Plans

If you would like to get a free quote or just want information mailed to your home please click the Aetna Medicare Quote tab above or call (888) 620-8988